Like sands through the hourglass, so are the economic downturns of our lives. While it’s easy to look at them with nonchalance and just think that they’ll pass soon enough, successfully navigating through one can be challenging — especially from a CMO perspective. That’s right, we’re talking to all you CMOs out there.

Why? Unfortunately, marketing spend is often one of the first budgets to be slashed during tighter financial times. Though, if armed with the right information and mindset, CMOs can make a compelling case to secure what your marketing team needs, and more.

The 2023 CFO Mindset

First, let’s shift gears from Marketing to Finance and take a look at the CFO mindset in 2023. They are tasked with keeping the ship afloat with essentially one hand tied behind their back. Customer acquisition costs are likely going up as buyers also feel the squeeze on their budgets. To put it bluntly, they’re looking for an effective quick win through cost management.

Understanding their stress points and what they’re trying to accomplish can better arm you, the CMO, with the data you need to swoop in and hit ‘em where it helps (not hurts). Let’s take a look at what you can talk about to allay their fears and sway the decision-making process in your favor.

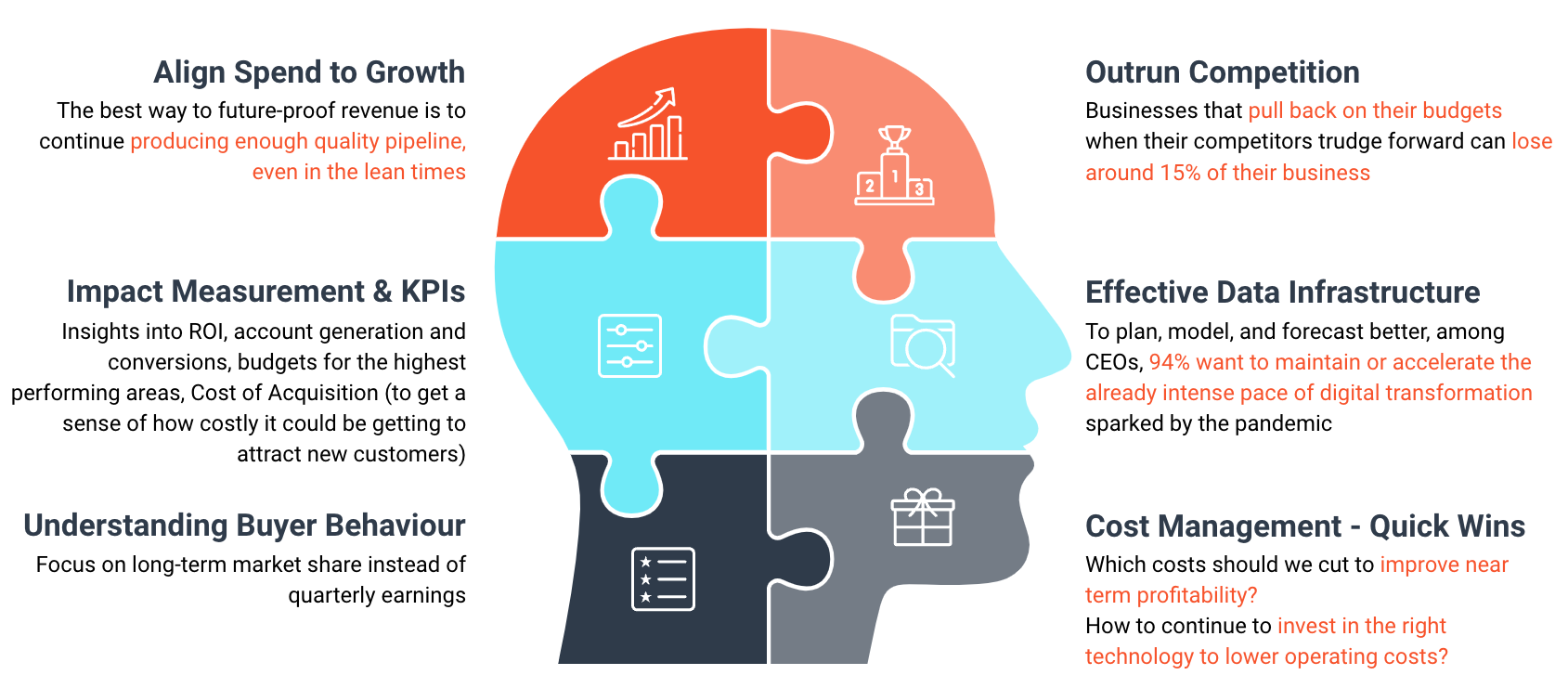

Marketing spend is always a strategic investment in the future of your company. That fact doesn’t change during an economic downturn—if anything, it becomes even more vital.

You can make the connection between successful marketing efforts and business growth. That connection can continue producing positive business outcomes, even in a more difficult economic climate.

By continuing to invest in your marketing efforts while your competitors divest, you’ll set yourself up for even greater growth when the economy starts to recover. As they say, ‘You have to spend money to make money.’ And you’re focused on spending it wisely.

Outrun the Competition

As stated previously, your competitors are most likely cutting their marketing spend anywhere from slightly to steeply. Instead, by investing in it, you’ll have the opportunity to gain market share and stay top-of-mind with consumers in a way you may not have been able to previously.

That same investment can also help differentiate you from your competition and stand out in a crowd. Yours can be the voice everyone hears as the usual din dials back to a whisper.

It also bears repeating—by investing now while others pull back, you’ll be setting yourself up for even greater success when the market rebounds while your competitors are stuck playing catch up.

Impact Measurement & KPIs

Let’s not mince words. Marketing effectiveness shouldn’t be left up to chance. That’s where measurement and KPIs come into play. That line between marketing spend and the growth it brings in needs to be clearer than ever.

With robust metrics and by tracking KPIs you can determine the most effective marketing efforts and channel dollars to strategically optimize your spend and deliver maximum returns.

Sharing impact KPIs and pipeline projections with your CFO equips them with the right data to help:

- generate faster, more accurate revenue forecasting

- get more ROI from the same sales and marketing spend

- trim budget without sacrificing growth

Effective Data Infrastructure

Marketing data isn’t limited to just impact measurement and KPIs. It goes beyond that, which is why having a robust data infrastructure is so important. When you’ve identified all the metrics you want to track, you’ll be set to optimize your marketing spend to drive the most growth.

Beyond this, you’ll be able to extrapolate vast data insights that can be helpful in future planning, and even further your understanding of your customer base. Identifying near-term opportunities allows you to invest in prospects with the means and interest for easy wins in an economic downturn. Long-term, data and insights often uncover opportunities for innovation that will set you apart as buyers look for out-of-the-box solutions.

Streamlining your attribution data and insights builds trust through transparency with your CFO. Trust goes both ways and having it will only strengthen your business during difficult times.

Understanding Buyer Behavior

Knowing your customer is what marketers specialize in. By doubling down on research and analysis, you can get to know them on a whole new level. You’ll understand their pain points, and what motivates their buying decisions. This allows you to speak their language and tailor marketing messaging and initiatives like never before.

Not only will this mean more effective marketing efforts, but it also helps create a great affinity with your brand or product and drive conversion rates through the roof.

The importance of account quality over quantity only grows during uncertain times. The right message to the right buyers at the right time often results in an increase in ARR even when MQA (Marketing Qualified Account) volume drops.

Cost Management

You have to level with your CFO and let them know you understand where they’re coming from. You’re not asking for a marketing budget just so you can go about producing things all willy-nilly. You’re committed to effective cost management, and finding efficiencies wherever possible.

That means you’re going to prioritize the most impactful initiatives while streamlining less effective ones. That’s also going to be an ongoing process where you’re constantly evaluating and analyzing so you can be nimble and adapt your efforts to favor positive business outcomes. Less isn’t always more, but you’re always committed to finding ways to do more with less.

So What Does This All Really Mean?

The conversation between a CMO and CFO may seem like a conflict to some, but in reality, it’s two experts coming together to figure out the best course of action. Armed with the above talking points, it’s easy to see how the two can work together to drive positive business outcomes while still keeping a balanced budget.

It may not be the easiest conversation to have, but with the right mindset, it can be one of your most productive conversations of the year.